Figuring out your taxes as a small business owner can feel like a guessing game since there isn’t a single tax form or single tax rate for all businesses. Not only do you need to plan around your future uncertain income — you also need to keep track of changing federal laws. As you get ready for another tax season, these strategies can help you determine your small business tax rates.

What Is the Federal Small Business Tax Rate?

Your tax rate changes based on the structure of your business.

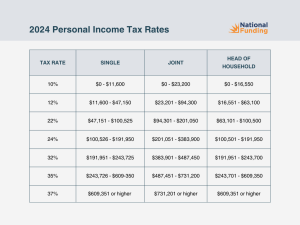

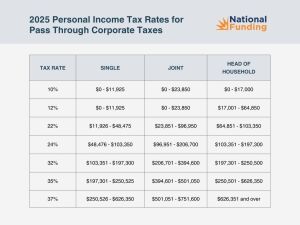

C Corporations must pay the flat corporate tax rate, which is currently 21% as of February 2025 and is the same rate as 2024. Sole proprietorships, partnerships, and S corporations are considered pass-through entities, so their incomes are taxed at the business owner’s personal tax rate, which remains between 10% and 37% for 2025 (see chart below for exact numbers from the IRS). Limited liability companies (LLCs) have the option to pay taxes as a corporation or as a pass-through entity.

You’ll see a few changes happened between 2024 and 2025 for taxes including:

- There was an increase of $400 for the standard deduction for singles and $800 for married couples filing jointly. For the head of household, the increase was $600.

- The 10% and 12% tax rates are now equal in 2025 where they were different in 2024.

How to estimate your 2025 small business taxes

Estimating your small business taxes is easy once you have your revenue number as your revenue for the year determines the rate you pay. Your revenue number can be found on your income statement, inside accounting software, or by adding up the total amount of units sold or services provided and paid for.

Pro-tip: Revenue does not include expenses like cost of goods sold (COGS), operating expenses, etc. These costs get deducted as you begin processing your taxes.

For C corporations, apply the current corporate tax rate of 21% to your company’s taxable income. Let’s say your C-corp has a taxable income of $100,000. Let’s calculate the tax due using the 2024 corporate tax rate of 21%:

Tax Due = Taxable Income x Tax Rate

Tax Due = $100,000 x 21%

Tax Due = $21,000

Unlike C corporations, where the business itself is taxed separately from the owners, pass-through business owners include their business earnings on their personal tax forms and pay 10%-37% taxes depending on their overall personal income.

Here’s how this is calculated if you have income/revenue of $150,000.

Tax Due = Taxable Income x Tax Rate

Tax Due = $150,000 x 32%

Tax Due = $48,000

This may seem like a lot of money, and it is. That’s why there are ways to reduce your tax liability (how much you owe) via expenses and deductions like the Section 179 deduction.

How to reduce small business taxable income

A small business owner can reduce their taxable income by taking advantage of tax credits and exploring different deductibles.

- Deductible Business Expenses: Deduct business expenses such as office supplies, marketing costs, and travel expenses. Make sure to keep all receipts.

- Home Office Deduction: If you use a portion of your home exclusively for your business, you may qualify for a home office deduction, allowing you to deduct some of your mortgage or utilities.

- Retirement Savings: Contributions to retirement plans such as 401(K) or Simplified Employee Pension (SEP) are tax deductible.

- Section 179 Deduction: Use Section 179 to deduct the costs of certain business items like equipment or heavy machinery.

- Business Tax Credits: Explore business tax credits such as the Work Opportunity Tax Credit (WOTC) for hiring certain employees or the Small Business Health Care Tax Credit for providing employees with health coverage.

- Consult a Professional: Seek advice from a professional tax accountant who can provide personalized guidance based on your business structure, industry, and other factors.

Keep in mind that tax laws are always changing, so it is crucial to stay up to date with the latest regulations or consult with a tax professional to ensure compliance and maximized deductions.

Small Business Tax Deadlines in 2025

Estimated Tax Deadlines

Businesses and freelancers in the U.S. must file and pay estimated income taxes quarterly instead of paying the whole amount all at once. Quarterly payments help small businesses by distributing the tax burden across the year, preventing a large and unexpected tax liability at the end of the fiscal year.

Businesses and freelancers must file 2025 quarterly taxes by the following dates:

- First Quarter, January – March: Due April 15, 2025

- Second Quarter, April – May: Due June 15, 2025

- Third Quarter, June – August: Due September 15, 2025

- Fourth Quarter, September – December: Due January 15, 2026

Please note these dates are different from last year (2024) where the second quarter was due June 17, and the third quarter was due September 16th.

Important Small Business Tax Dates in 2025

Efficiently managing your budget each quarter helps you prepare to pay taxes. If you do not have the funds to pay your taxes or pay late, you can be fined. Each state and the District of Columbia have different penalties, so please visit your state’s local tax and revenue website to see yours. The IRS calculates their penalty and charges interest on the penalty based on the following:

- The amount of the underpayment

- The period when the payment was due and underpaid

- The published quarterly interest rates for underpayments

This is why it is important to make sure you pay your taxes on time and that you get contractors and employees their tax forms. If you are late to get their tax documents, they may be late to pay and may also receive tax penalties.

Here’s some important dates to remember and what to have completed before they approach.

January 31, 2025

- Employees Must Receive W-2 Forms

- Independent Contractors Must Receive 1099 Forms

February 15, 2025

- Reclaim your exemption from withholding with the W4 form (contact the IRS for more information here.)

March 17, 2025

- Switch Business Election to S Corporation for 2024 Taxes

April 15, 2025

- Tax Day (unless extended due to local state holiday)

- Deadline to File Form 4868 and request an extension

- Deadline to make IRA and HSA contributions for 2024 tax year

- First quarter 2025 estimated tax payment due

June 15, 2025

- Second quarter 2025 estimated tax payment due

September 15, 2025

- Third quarter 2025 estimated tax payment due

October 15, 2025

- Deadline to file the extended 2024 tax return

January 15, 2026

- Fourth quarter 2025 estimated tax payment due

Where an Accountant can help

Accountants help to remove many of the headaches of paying taxes, as they specialize in both federal and local tax requirements, keep up to date on tax rate changes, and can answer any questions business owners like yourself have regarding the updates each year.

A good small business accountant will review previous years’ tax filings and look for missed deductions as they may have up to three years to file an amendment. This can get you money back from the IRS for overpayments and missed deductions.

Knowledgeable accountants minimize a business’s tax liability by taking advantage of all credits and deductions available to your business based on what you do and where you’re located. But not all businesses are the same, so if your current accountant is looking at you just like their other clients, it may be time to switch.

Accountants also keep track of important tax deadlines so that you can share the responsibility. This helps you avoid late filing penalties and ensure compliance with the law. One of the most beneficial perks of having a small business accountant is in case of an audit. Your accountant will provide support and guidance to meet the audit requirements, reducing your stress and worry. Some accountants will even get on the phone with the IRS and handle it for you, allowing you to focus on your business.

National Funding does not provide tax, legal or accounting advice. This material has been prepared for informational purposes only. You should consult your own tax, legal and accounting advisors.